Want to Make the Most of Your BP Benefits?

Our team provides the most current information on your BP Benefit Plan options. We try to help ensure you are maximizing all retirement plan avenues available within your employer plan. We assist our clients in properly allocating their retirement funds to fit their risk tolerance and retirement planning goals. It is imperative as an employee you understand how to maximize your contributions so you don’t leave employer money on the table.

BP Employee Savings Plan (ESP) Contribution Limits & Retirement Planning (2026)

The BP Employee Savings Plan (ESP) is a comprehensive retirement savings program designed to help BP employees take advantage of the highest contribution levels permitted under IRS rules. Understanding how the ESP works—and how it integrates with BP’s excess benefit and compensation plans—is critical for maximizing long-term retirement outcomes.

A common misconception among BP employees is that 401(k) contributions are limited to $24,500 in 2026 ($32,500 if you are age 50 or older, or $35,750 if you are between ages 60–63). These figures represent the IRS limits for employee elective deferrals, which include traditional pre-tax and Roth 401(k) contributions.

In addition to employee deferrals, the IRS also sets a separate limit on total annual contributions to a defined contribution retirement plan. This “all-in” limit includes employee contributions, BP’s company match, and after-tax employee contributions. For 2026, the total combined contribution limit is $72,000, with eligible catch-up contributions allowed on top of that amount. As a result, total annual retirement contributions for BP employees may reach:

- $72,000 (under age 50)

- $80,000 (age 50+)

- $83,250 (age 60–63)

After-Tax Contributions in the BP ESP

BP’s ESP allows after-tax 401(k) contributions beyond the standard employee deferral limits. These after-tax contributions can significantly increase the amount a BP employee saves for retirement and play an important role in advanced tax planning strategies. The distinction between contribution types is not simply whether they are deductible, but how they are taxed—pre-tax, Roth, and after-tax contributions each follow different tax rules and can serve different long-term planning objectives.

Specialized Planning for BP Employees

For BP employees who consistently maximize their 401(k) contributions, the next planning decisions are rarely straightforward. These decisions are driven by details specific to the BP Employee Savings Plan, including how after-tax contributions, company matching, and BP’s excess benefit arrangements interact.

For more than 20 years, our practice has focused almost exclusively on the BP retirement system. We have dedicated our work to understanding the nuances of the BP ESP, the Excess Benefits Plan (EBP), and the Excess Compensation Plan (ECP), and how these plans work together. This level of specialization matters, because small differences in how contributions are structured can have long-term tax and retirement implications. To review how these rules apply to your situation, visit our Contact page.

BP Company Match, Excess Benefits Plan, and Excess Compensation Plan

Another common misconception is that BP stops matching contributions once IRS limits are reached. BP’s objective is to provide the full 7% company match, even when qualified plan limits prevent additional contributions to the ESP.

Once the IRS “all-in” contribution limit has been reached within the ESP, BP continues providing the company match through the Excess Benefits Plan (EBP). The EBP is funded entirely by BP and accepts only company matching contributions—employees cannot contribute directly to this plan. Its sole purpose is to ensure eligible employees continue receiving BP’s match after qualified plan limits are reached.

BP also offers the Excess Compensation Plan (ECP) for situations in which IRS compensation limits restrict how much income can be recognized for 401(k) matching purposes. When those limits apply, BP may be unable to deposit the full match into the ESP, and the ECP is used to provide the remaining employer contribution outside the qualified plan.

If you are affected by these limits or participate in the EBP or ECP, working with a firm that understands the full BP retirement structure can help ensure your benefits are coordinated properly within your overall retirement strategy.

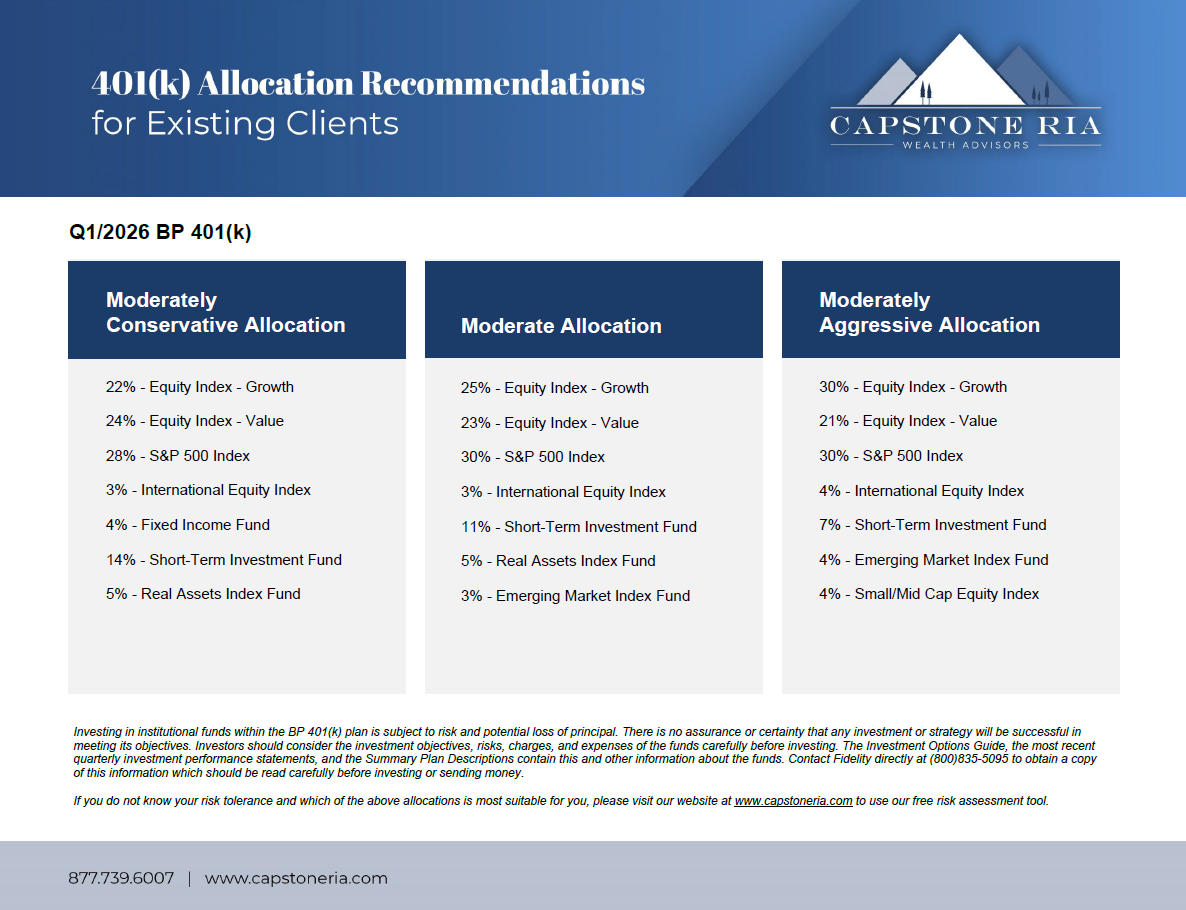

Why You Should Reconsider Investing in Target Date Funds

Capstone RIA currently does not recommend investing in any of the Target Date investment options offered inside the plan due to several issues relating to the lack of public disclosure for these options. Additionally, the Target Date options offered within the plan are investment funds that own other funds. This means you are paying multiple layers of asset management fees for every fund the Target Date option invests in. Because of this, we are not currently recommending you invest in these funds.

RAP Overview

BP Retirement Accumulations Plan (RAP) Overview

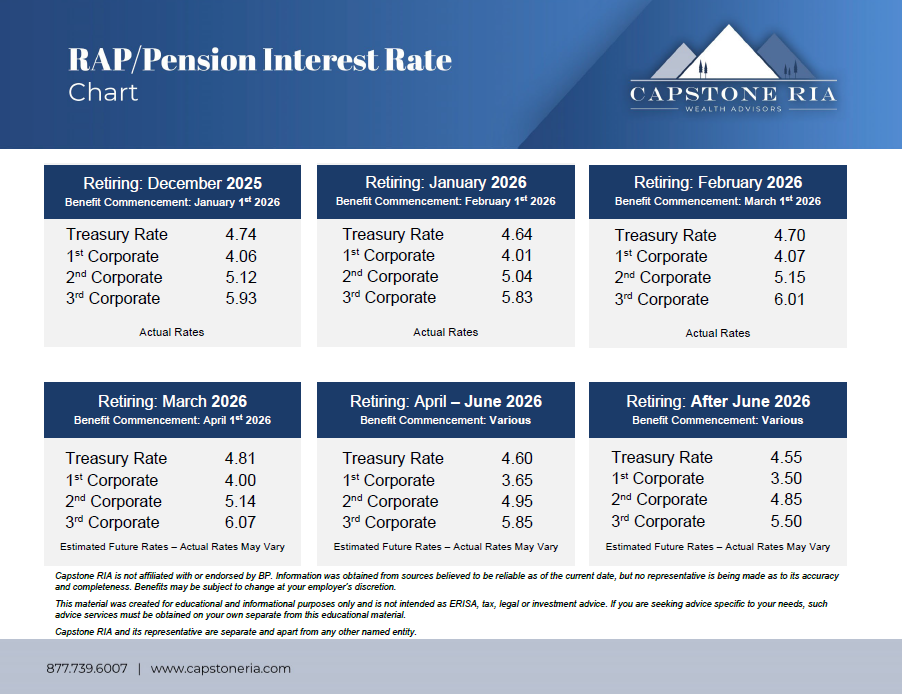

Electing how to take your BP RAP, also known as your pension, is a major decision and requires that you know the facts about how each different option could impact you. Our team strategically plans and monitors interest rates, forecasting future rates and helps advise you as to when the most optimal time to elect for your pension would be.

On a monthly basis we provide updated figures as well as our expectation for where interest rates are heading so you can make the most informed decision about your pension at retirement. If you would like to receive our monthly email commentary along with updated pension figures, please add your name to our email list.

Are You Torn Between Electing for the Lump Sum vs Annuity Option?

Lump Sum Option

Offered under both heritage and non-heritage employees, a lump sum distribution is a one-time payment from your pension available at retirement or separation from the company. By taking a lump sum payment, you gain access to a large sum of money, which you can spend or invest as you see fit.

Here is a simplified explanation of how the lump sum is factored:

A monthly stream of annuity payments has an identifiable present value based on the recipient’s life expectancy and current interest rates at the time of retirement. Think of it like this, if the company is obligated to pay you $1,000 per month for the rest of your life and you are expected to live for 25 more years then the company will be paying you $1,000 x 12 months x 25 years, equaling a total of $300,000 over that time period. The company looks at it from the perspective of if it is obligated to pay you $1,000 per month for 25 years, they will likely invest an amount of money today into high-grade bonds which will provide you with that monthly cashflow. If bond interest rates are low the company will need to invest a larger amount of money today to make the payments versus if rates are higher. In simple terms, the lump sum payment is essentially equal to the amount of money the company needs to invest to make that payment. This is why traditional defined benefit plans produce a larger lump sum payment when interest rates are low and a lower lump sum when interest rates are high. The lump sum option allows you the greatest amount of flexibility and control versus the annuity options. Lump sums are eligible to be rolled over to an IRA, deferring taxes and giving you control of when and how much you wish to withdraw from the IRA. They also allow you the flexibility to choose from a broad selection of investment options, allowing you to make the decisions you feel are necessary to fit your individual situation, goals, risk tolerance, time horizon’s, etc. Lump sum rollovers are by far the most widely elected option for retirees.

Annuity Option

Under the Heritage plans, the annuity options available to you in your RAP are calculated based on five main factors including your service history, age (this includes your spouse’s age if married), interest rates at retirement, final average earnings and a social security based calculated factor. Together these components comprise the value of your monthly annuity payment. The annuity option also comes with some specific rules that once enacted cannot be undone. Most notably is the absence of a Cost Of Living Adjustment (COLA). A COLA is essentially the equivalent to getting a raise when you were working. Imagine working at a job that never gave you a raise; that doesn’t sound very attractive does it?

A COLA annual increase generally coincides with inflation in an attempt to keep your annuity payment increasing as prices of goods and services you regularly use also increase over time. Because there is no provision any longer for a COLA within the RAP, your annuity payment will never be more than what it is when you begin collecting it. This is one of the most significant deterrents to selecting the annuity option because as your bills go up over time your income does not.

Another major issue with taking the annuity option is once you elect to take it you give up your ability to convert it into a lump sum at a later date and you cannot pass it along after you die except under very limited circumstances. Meaning if you were to become sick and needed special medical care, you could not use the annuity’s value to pay the medical bills and once you pass away there is no money passed to your estate.

Heritage Employees

If you worked for one of the companies BP acquired in the past you are likely considered to be a “Heritage employee”. Heritage employees are given special treatment when it comes to their pension accounts and receive the benefit of either taking the better of their old company’s pension benefits or the pension benefits offered under the BP Retirement Accumulation Plan (RAP) calculation. Most Heritage pension plans were structured as a traditional Defined Benefit Plan where the BP RAP is a Cash Balance Plan. The difference between these two plans is essentially the way they are calculated.

Defined Benefit Plans

Employee benefits are calculated according to length of service, age, salary earned at the time of retirement, and corporate interest rates. The primary benefit you accrue is a lifetime annuity, but you are also offered several other options including a single lump sum payment. The overwhelming majority of people elect to take their pension as a lump sum payment for a variety of factors.

Cash Balance Plans

Like a traditional defined benefit plan, a cash balance plan provides employees with the option of a lifetime annuity. However, unlike defined benefit plans, cash balance plans create an individual account for each employee which includes a specified lump sum. When the employee retires, they are given the option to take either the lump sum amount or they can convert that lump sum into an annuity payment. Under cash balance plans, higher interest rates generally mean larger annuity payments and larger lump sum payments.

Other BP Benefit Plans to Consider

Our team can help you understand all areas of your BP Plan and benefits. We have been dedicated to serving employees of BP for over 21 years and have worked with executives and associates on all levels.

If you have any of the following non-standard BP retirement plans and need assistance or want to ensure you are taking the most advantageous route using these benefits, call us today!

- BP Excess Compensation (Savings) Plan

- BP Excess Benefit (Savings) Plan

- BP Deferral Savings Restoration Plan

- BP Share Value Plan (SVP)

- ACB Deferral Plan

- BP Medical Program

- RRSP Plan

- BP Excess Compensation (Retirement) Plan

- BP Excess Benefit (Retirement) Plan

- BP America Inc. Supplemental Retirement Accumulation Plan

- BP Supplemental Executive

- Retirement Benefit Plan

Looking for assistance in managing your assets?

To join our growing business, call us today to schedule a complimentary consultation. Our team can help assist you in all areas of retirement and have been working with oil & gas employees for over 17 years. We keep our clients’ best interest at the forefront of our decision-making and focus on you. Contact us today!