BP Employees,

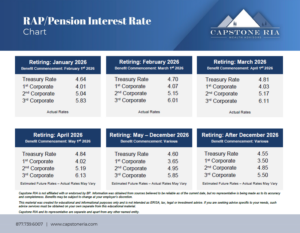

Interest rates used to calculate BP RAP pension lump sums moved very little this month, resulting in minimal changes to lump-sum values. Overall, the rates came in very close to our expectations, with only small movements across the Corporate Segment rates. For most participants, the net impact on lump-sum values was modest, and for many, interest rate credits applied to RAP balances likely outweighed the effect of these minor rate changes.

This continues the recent trend of relative stability. Over the past several months, pension interest rates have fluctuated within a narrow range, leading to generally steady lump-sum calculations.

Federal Reserve update

The Federal Reserve met this week and held short-term interest rates unchanged, reinforcing its data-dependent approach. Chair Jerome Powell emphasized that while inflation has moderated, it remains above the Fed’s long-term target, and the Committee is balancing that concern against a labor market and economy that remain resilient. The Fed reiterated that future policy decisions will depend on incoming inflation, employment, and economic data rather than a pre-set path.

Looking ahead

Based on current economic conditions and the structure of the Corporate Segment rates used in BP pension calculations, we expect next month’s pension interest rates to show minimal change, with a slight upward bias. Any increases, if they occur, are likely to be modest rather than abrupt.

For employees considering retirement timing, this suggests that the interest-rate environment remains relatively stable. Opportunities tied to lump-sum values can still shift gradually over time and monitoring month-to-month changes remains important, especially for those nearing a retirement decision.

Why this matters

BP pension lump-sum values are directly influenced by interest rates, and even small movements can meaningfully affect the amount available at retirement. With rates remaining relatively stable and the Federal Reserve proceeding cautiously, this is a good time to reassess retirement timing, evaluate lump-sum versus annuity options, and understand how current conditions may impact decisions in 2026.

What you can do

If you are approaching retirement—or simply want to better understand how interest-rate changes affect your BP RAP pension—we are happy to help. We can model different retirement dates, compare lump-sum and annuity options, and show how potential rate changes could impact your overall retirement plan.

If you would like to discuss your situation in more detail, please email us at info@CapstoneRIA.com or call (877) 739-6007 to schedule a free, no-obligation consultation.

Next update

We will continue monitoring interest rates, inflation trends, and Federal Reserve policy and will provide another update next month.

Best wishes,

Capstone RIA

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Capstone RIA and its representatives are separate and apart from BP or Fidelity Investments.