BP Employees,

What changed this month

What changed this month

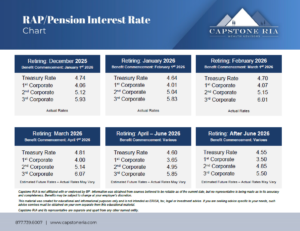

Interest rates used to calculate BP RAP pension lump sums were little changed in December. While some segments moved slightly up and others slightly down, the overall effect was negligible, leaving lump-sum values largely steady compared with last month. Over the past three months, these rates have also remained relatively stable, meaning minimal overall changes in pension lump-sum values during that period. For most participants, interest rate credits applied to your RAP account will likely outweigh any small effects from Corporate Segment rate fluctuations.

Looking ahead

As we move into early 2026, current US economic conditions imply interest rates will likely remain under downward pressure, though the pace could slow. The Federal Reserve met on December 10th 2025 and lowered the federal funds rate, noting that additional cuts remain possible if inflation continues to cool and despite the fact that economic growth has remained robust—GDP recently came in at 4.3%, a full percentage point above expectations. Inflation data has cooled more than anticipated, even with the impact of the Trump tariffs, and while unemployment has ticked up slightly, that increase reflects higher labor-force participation rather than job losses. Overall, the economy continues to show surprising strength, based on the latest data.

For BP employees who are thinking about when to retire, the current rate environment suggests that interest rates may stay in a generally favorable range for now. However, any further rate movements are likely to come gradually rather than through large, sudden changes.

Chair Jerome Powell explained that the goal is to keep prices under control while helping the economy continue to move forward, aiming to ensure that inflation stays on a sustainable downward path while allowing the economy’s recent momentum—including stronger-than-expected GDP growth last quarter—to continue without reigniting price pressures.

Why this matters

BP pension lump-sum calculations are directly influenced by interest rates, and even modest rate shifts can have a noticeable impact on lump-sum values. With rates now lower than they were earlier in 2025 and the Federal Reserve maintaining a measured, supportive stance, the current environment presents a strong opportunity for employees to review their retirement timing and evaluate potential advantages for 2026.

What you can do

If you’re approaching retirement—or simply want to understand how current interest rates impact your BP RAP pension—now is the perfect time to review your options. We can help you compare different retirement dates, evaluate lump-sum versus annuity trade-offs, and understand how interest-rate changes affect your overall plan.

If you would like to discuss your situation in more detail, email us at info@CapstoneRIA.com or call us directly at (877) 739-6007, and we will be happy to schedule a free, no-obligation consultation with our Financial Advisors.

Next update

We’ll continue monitoring interest rates, inflation data, and Federal Reserve policy as we head into the new year, and we’ll provide another update next month.

Best wishes,

Capstone RIA

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Capstone RIA and its representatives are separate and apart from BP or Fidelity Investments.