BP Employees,

This month, the rates used to calculate BP lump sum pensions haven’t moved enough to cause any significant change to your lump sum value. So if you’re planning to retire sometime soon, this month’s rate movement shouldn’t materially impact your payout.

So, what’s going on?

Overall, bond yields have stayed in a tight range lately. However, we are watching the situation in the Middle East — tensions between Israel and Iran have the potential to affect global oil prices. Any sharp move in oil could push bond rates to react, which in turn could impact future pension lump sum calculations.

What does this mean for you?

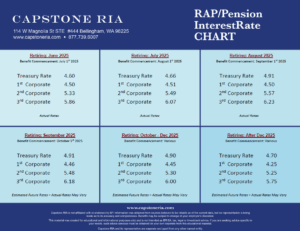

If you’re planning to retire this summer or later this year, please use the above Capstone RIA BP RAP Interest Rate Chart to match your retirement timeline and plug in the appropriate rates to get a solid estimate of your lump sum. If you’re unsure how to do that, or want help running the numbers, we’re here to help.

Bottom line:

While rates are stable for now, it’s smart to keep an eye on things — global events can shift markets quickly. If you’re within a year or so of retirement, it’s worth reviewing your options and seeing how even small rate changes might affect your payout.

As always, reach out if you’d like help reviewing your options or need a custom projection.

If you’re not currently working with our team and want to discuss your personal situation with one of our experienced financial advisors — who specialize in the intricacies of BP retirement plans — email us at info@CapstoneRIA.com or call our office directly at (877) 739-6007. There’s no cost or obligation to have a conversation.

Best wishes,

Capstone RIA

Bellingham, WA

877-739-6007

Economic forecasts set forth may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Stock investing involves risk, including loss of principal. International & Emerging Markets investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in Emerging Markets.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Confidentiality Notice: This email transmission and its attachments, if any, are confidential and intended only for the use of particular persons and entities. They may also be work product and/or protected by the attorney-client privilege or other privileges. Delivery to someone other than the intended recipient(s) shall not be deemed to waive any privilege.

Capstone RIA and its representatives are separate and apart from any other named entity.